UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

| | | | |

| | þ | Filed by the Registrant | ¨ | Filed by a Party other than the Registrant |

|

| |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §.240.14a-12 |

AZZ INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | |

| Payment of Filing Fee (Check the appropriate box): |

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

20192020

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT

AZZ Inc.

One Museum Place, Suite 500

3100 West 7th Street

Fort Worth, Texas 76107

May 28, 201927, 2020

Dear Shareholders:

The Board of Directors and Management of AZZ Inc. cordially invite you to attend our 20192020 Annual Meeting of Shareholders to be held at 10:00 a.m., local time, on Tuesday,Wednesday July 9, 2019,8, 2020, at One Museum Place, 4th Floor, 3100 West 7th Street, Fort Worth, Texas 76107. Details regarding the business to be conducted at the Annual Meeting are more fully described in the accompanying materials. The Notice of the 20192020 Annual Meeting of Shareholders and Proxy Statement are attached. Please read them carefully.

All shareholders are invited to attend the meeting. Your vote is very important to our business and to our continued success. Whether or not you plan to attend the meeting, it is important that your shares be represented and voted at the meeting. If you receive a paper copy of the proxy materials, you may use the telephone or Internet voting procedures described on the proxy card or complete and mail the enclosed proxy card. If you decide to attend the 20192020 Annual Meeting of Shareholders, you will be able to (i) vote in person if you are a shareholder of record, or (ii) if you are a beneficial holder and have obtained a legal proxy, you may vote in person at the meeting, even if you have previously submitted your proxy.

ThankAlthough we intend to hold the Annual Meeting in person, we are monitoring the protocols that federal, state and local governments may recommend or require in light of the evolving coronavirus (COVID-19) pandemic. If it is necessary or appropriate to take additional steps regarding how we conduct our meeting, we will announce our decision in advance and details on how to participate will be posted on our website and filed with the Securities and Exchange Commission.

We ask for your voting support on the items described in this proxy statement and thank you in advance for voting and for your continued support of AZZ Inc.

Sincerely,

/s/ Thomas E. Ferguson

Thomas E. Ferguson

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on July 9, 20198, 2020

To the Shareholders of AZZ Inc.:

NOTICE IS HEREBY GIVEN that the 20192020 Annual Meeting of Shareholders (the “Annual Meeting”) of AZZ Inc. (hereinafter, the “Company” or “AZZ”) will be held as follows:

|

| | |

| TIME AND DATE | | 10:00 a.m., local time, on Tuesday,Wednesday, July 9, 20198, 2020 |

| | |

| LOCATION | | One Museum Place, 3100 West 7th Street, 4th Floor, Fort Worth, Texas 76107* |

|

| | | |

| | |

| PROPOSALS | | I. | Elect the nineeight (8) director nominees named in the accompanying Proxy Statement to serve on the Company’s Board of Directors, each for a one-year term. |

| | |

| | | II. | Vote for an advisory approval of a non-binding resolution approving the Company’s executive compensation program. |

| | |

| | | III. | Vote for the ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 29, 2020.28, 2021. |

| | |

| | | IV. | To transact any other business which may properly come before the Annual Meeting or any adjournment. |

|

| | |

| RECORD DATE | | You can attend and vote your shares at the Annual Meeting if you were a shareholder of record of the Company’s common stock at the close of business on May 10, 20198, 2020 (the “Record Date”). |

| | |

| NOTICE | | A Notice Regarding the Availability of Proxy Materials (the “Notice”) was mailed to shareholders on or about May 28, 2019.27, 2020. |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 20192020 ANNUAL MEETING OF SHAREHOLDERS

AZZ’s Proxy Statement and Fiscal Year 20192020 Annual Report are available at www.edocumentview.com/AZZ |

| | |

| VOTING | | Your vote is very important. Even if you intend to be present at the Annual Meeting, please promptly vote in one of the following ways so that your shares may be represented and voted at the Annual Meeting: • Call the toll-free telephone number shown in the instructions included on your Notice; • Vote via the Internet on the website as described in the instructions included on your Notice; or • If you receive a paper copy of the proxy materials, complete, sign, date, and return your proxy card or voting form. |

|

| | |

| | | |

| | | By Order of the Board of Directors, /s/ Tara D. Mackey Tara D. Mackey Chief Legal Officer and Secretary |

*Although we intend to hold the Annual Meeting in person, we are monitoring the protocols that federal, state and local governments may recommend or require in light of the evolving coronavirus (COVID-19) pandemic. If we should determine it is necessary or appropriate to take additional steps regarding how we conduct our meeting, we will announce our decision in advance and details on how to participate will be posted on our website and filed with the Securities and Exchange Commission.

|

| |

| TABLE OF CONTENTS | Page |

| | |

| Proxy Statement Summary | |

| | |

| Questions and Answers | |

| | |

| PROPOSAL 1 – ELECTION OF DIRECTORS | |

| | |

| Election Process | |

| Nominees for Election of Directors | |

| | |

| Matters Relating to Corporate Governance, Board Structure, Director Compensation and Stock Ownership | |

| | |

| Certain Relationships and Related Party Transactions | |

| | |

| Director Compensation | |

| | |

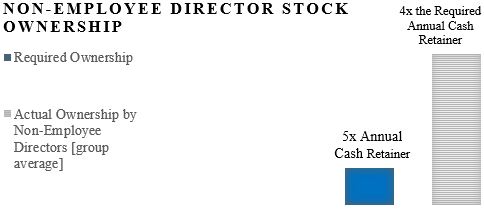

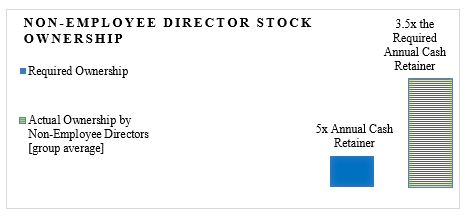

| Non-Employee Director Stock Ownership Guidelines | |

| | |

| Procedures for Communicating with Directors | |

| | |

| Director Nomination Process | |

| | |

| Security Ownership of Management and Directors | |

| | |

| Security Ownership of Certain Beneficial Owners | |

| | |

| PROPOSAL 2 – APPROVAL OF THE SAY-ON-PAY PROPOSAL | |

| | |

| Executive Compensation | |

| Compensation Discussion and Analysis | |

| Stock Ownership Guidelines for Executive Officers | |

| Compensation Committee Report | |

| Summary Compensation Table | |

| Grants of Plan Based Awards | |

| Outstanding Equity Awards at Fiscal Year End | |

Option/SAR Exercises and Stock Vested for Fiscal Year 20192020 | |

| Potential Payments Upon Termination or Change of Control | |

| CEO Pay Ratio | |

| | |

| Audit Committee Report | |

| | |

| Relationship with Independent Auditors | |

| | |

| PROPOSAL 3 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| | |

| Other Information | |

| | |

PROXY STATEMENT SUMMARY

This summary below highlights information contained elsewhere in this proxy statement (“Proxy Statement”). This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find additional information in this Proxy Statement.

20192020 Annual Meeting of Shareholders

|

| |

Date and Time July 9, 2019,8, 2020, 10:00 a.m., local time | Place AZZ Inc., One Museum Place, 4th Floor, 3100 West 7th Street, Fort Worth, Texas 76107 |

Notice We mailed a Notice Regarding the Availability of Proxy Materials (the “Notice”) on or about May 28, 2019.27, 2020. | Voting Holders of shares of common stock as of the Record Date are entitled to vote on all matters. |

Record Date May 10, 20198, 2020 | |

Voting Matters

| | | Item | | Company Proposals | | Board Vote Recommendation | | Page | | Company Proposals | | Board Vote Recommendation | | Page |

| | | |

| 1. | | Election of nine Directors | | FOR each director nominee | | 13 | | Election of eight (8) Directors | | FOR each director nominee | | 13 |

| | | |

| 2. | | Approval, on a non-binding advisory basis, of the Company’s executive compensation program | | FOR | | 34 | | Approval, on a non-binding advisory basis, of the Company’s executive compensation program | | FOR | | 35 |

| | | |

| 3. | | Ratification of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 29, 2020 | | FOR | | 70 | | Ratification of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 28, 2021 | | FOR | | 73 |

How to Vote

You can vote by any of the following methods:

|

| |

| Internet (www.envisionreports.com/AZZ) until 1:00 a.m. Eastern Time, on July 9, 2019;8, 2020; |

| Telephone (1-800-652-8683) until 1:00 a.m. Eastern Time, on July 9, 2019;8, 2020; |

| Completing, signing and returning your proxy or voting instruction card before July 9, 2019;8, 2020; or |

| In person, at the Annual Meeting, if you are a registered shareholder as of the Record Date. You may deliver a completed proxy card or vote by ballot at the meeting. |

Corporate Governance Highlights

|

| | | |

| ü | EightSeven out of nineeight director nominees are independent | ü | Independent committee chairs and members |

| ü | Commitment to continuous board refreshment and diversity | ü | Separate chairman and CEO |

| ü | Annual election of all directors | ü | Regular executive sessions of independent directors |

| ü | Majority voting for directors | ü | Risk oversight by full board and committees |

| ü | Stock ownership guidelines for directors and officers | ü | Annual board and committee self-evaluations |

Director Nominees

| | | Name | Age | DirectorSince | Occupation | Committee Memberships | Other Public Company Boards | Age | DirectorSince | Occupation | Committee Memberships | Other Public Company Boards |

| Daniel E. Berce | 65 | 2000 | President and Chief Executive Officer, General Motors Financial Company | Audit Compensation | 2 | 66 | 2000 | President and Chief Executive Officer, General Motors Financial Company | Audit Compensation | 2 |

| Paul Eisman | 63 | 2016 | Former President and Chief Executive Officer, Alon USA Energy, Inc. | Audit Compensation | 0 | 64 | 2016 | Former President and Chief Executive Officer, Alon USA Energy, Inc. | Audit Compensation | 0 |

| Daniel R. Feehan | 68 | 2000 | Chairman of the Board, FirstCash, Inc. | Compensation Nominating and Corporate Governance | 2 | 69 | 2000 | Chairman of the Board, FirstCash, Inc. | Compensation Nominating and Corporate Governance | 2 |

| Thomas E. Ferguson | 62 | 2013 | President and Chief Executive Officer, AZZ Inc. | Not Applicable | 0 | 63 | 2013 | President and Chief Executive Officer, AZZ Inc. | Not Applicable | 0 |

| Kevern R. Joyce | 72 | 1997 | Independent Business Consultant and Investor | Nominating and Corporate Governance | 0 | 73 | 1997 | Independent Business Consultant and Investor | Nominating and Corporate Governance | 0 |

| Venita McCellon-Allen | 59 | 2016 | President and Chief Operating Officer, Southwestern Electric Power Company | Audit Compensation | 0 | 60 | 2016 | President and Chief Operating Officer, Southwestern Electric Power Company | Audit Compensation | 0 |

| Ed McGough | 58 | 2017 | Senior Vice President, Global Manufacturing and Technical Operations, Alcon Laboratories, Inc. | Compensation Nominating and Corporate Governance | 0 | 59 | 2017 | Senior Vice President, Global Manufacturing and Technical Operations, Alcon Laboratories, Inc. | Compensation Nominating and Corporate Governance | 0 |

| Stephen E. Pirnat | 67 | 2014 | Former Chief Executive Officer, ClearSign Combustion Corporation | Audit Nominating and Corporate Governance | 0 | |

| Steven R. Purvis | 54 | 2015 | Trustee and Portfolio Manager, Luther King Capital Management | Audit Nominating and Corporate Governance | 0 | 55 | 2015 | Trustee and Portfolio Manager, Luther King Capital Management | Audit Nominating and Corporate Governance | 0 |

Named Executive Officers

| | | Name | | Age | | Position | | Since | | Previous Position | | Age | | Position | | Since | | Previous Position |

| Thomas E. Ferguson | | 62 | | President and Chief Executive Officer | | 2013 | | Chief Executive Officer, FlexSteel Pipeline Technologies, Inc. | | 63 | | President and Chief Executive Officer | | 2013 | | Chief Executive Officer, FlexSteel Pipeline Technologies, Inc. |

| Paul W. Fehlman | | 55 | | Senior Vice President and Chief Financial Officer | | 2014 | | Vice President, Finance, Engineered Products Division, Flowserve Corporation | | 56 | | Former Senior Vice President and Chief Financial Officer | | 2014 | | Vice President, Finance, Engineered Products Division, Flowserve Corporation |

| Matthew Emery | | 52 | | Chief Information and Human Resources Officer | | 2013 | | Senior Director of Information Technologies, Hewlett-Packard | |

| Tara D. Mackey | | 49 | | Chief Legal Officer and Secretary | | 2014 | | Chief Legal Counsel and Corporate Secretary, First Parts, Inc. | | 50 | | Chief Legal Officer and Secretary | | 2014 | | Chief Legal Counsel and Corporate Secretary, First Parts, Inc. |

| Gary Hill | | | 55 | | President and General Manager - Industrial | | 2017 | | President and General Manager - AZZ WSI LLC |

| Kenneth Lavelle | | 62 | | President and General Manager - Electrical | | 2017 | | President, Global Seals & Systems Operation, Flowserve Corporation | | 63 | | President and General Manager - Electrical | | 2017 | | President, Global Seals & Systems Operation, Flowserve Corporation |

Executive Compensation Highlights

Compensation Philosophy and Objectives

Our key compensation objectives are to attract and retain high performance leaders, reward results, drive future strategic growth and align the long-term interests of our executives with those of our shareholders. We use the following principles to effect these objectives:

|

| |

| What We Do |

| |

ü | A significant portion of our executive officers’ total compensation is financial performance based, and the payout ispayouts are contingent upon the attainment of certain pre-established performance metrics.metrics and capped to minimize risk. |

ü | Performance measures are highly correlated to the creation of shareholder value. |

ü | We review and benchmark pay relative to the market median of our industry peer group on an annual basis. |

ü | Our executive compensation program is designed to encourage building long-term shareholder value and attract and retain high performance executive talent. |

ü | We use annual cash incentive opportunities and equity-based awards to balance the Company’s short- and long-term performance objectives. |

ü | Our equity awards are equally weighted between time-vested restricted stock units, which vest ratably over a three-year period, and performance share units, which require achievement of financial performance metrics over a three-year performance cycle. |

ü | The compensation committee engages an independent executive compensation consultant. |

ü | Our compensation committee conducts an annual review of all executive compensation program components to ensure alignment with our compensation objectives and the Company’s industry peers. |

ü | We implemented a Compensation Recovery Policy to protect the Company in the event of a financial restatement or an executive officer engages in serious misconduct. |

ü | We provide a limited number of employment agreements and executive perquisites. |

ü | We have stock ownership guidelines for directors and executive officers. |

|

| |

| | What We Don’t Do |

| |

| û | We do not provide tax gross ups. |

| û | We do not recycle shares withheld for taxes. |

| û | We do not permit pledging or hedging of Company securities. |

| û | We do not pay dividends or dividend equivalents on unearned RSUs or PSUs until they vest. |

| û | We do not reprice underwater equity awards. |

| û | We do not have pension or supplemental executive retirement plans. |

Fiscal Year 20192020 Executive Compensation Program Elements

|

| | | | |

| Category | | Compensation Element | | Description |

| Cash | | Base Salary | | Fixed cash compensation based on responsibilities of the position. Reviewed annually for potential adjustments based on factors such as market levels, individual performance and scope of responsibilities. |

| | | Annual Incentive Opportunity | | Annual cash incentive for achievement of specific annual financial operating results.

|

| Long-Term Incentives | | Restricted Stock Units | | Vest ratably over a three-year period. Settled in shares of AZZ common stock. Dividend equivalent rights accrue with respect to dividends awarded during the vesting period. |

| | | Performance Share Units | | Three-year pre-determined financial performance metric and a potential total shareholder return (“TSR”) modifier. Settled in shares of AZZ common stock. Dividend equivalents accrue during the vesting period and will vest if, and when the PSUs to which such dividend equivalents relate become vested.

|

| Retirement | | 401(k) Plan | | Qualified 401(k) plan available to all U.S. employees. The Company matches 100% of the first 1% and 50% of contributions between 2% and 6% (with a potential total Company match of 3.5%).

|

| Other | | Employment Agreements | | Sets standard benefits for Messrs. Ferguson and Fehlmancertain NEOs in the event of termination of employment from the Company. |

| | Deferred Compensation Plan | | Sets standard benefits for designated management and highly compensated employees (including our NEOs) and the Company's board of directors. |

| | | Severance Plan | | Sets standard benefit guidelines for senior executives in the event of severance; available to all U.S. employees (other than Messrs. Ferguson and Fehlman)NEOs with employment agreements). |

| | | Change-in-Control Agreements | | Sets standard benefits for senior executives (other than Messrs. Ferguson and Fehlman) upon a change-in-control. |

| | | Other Benefits | | Executive supplemental disability insurance, financial planning services and annual physical exam.exams. |

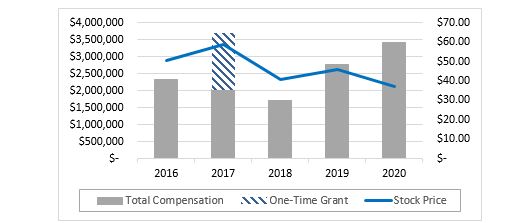

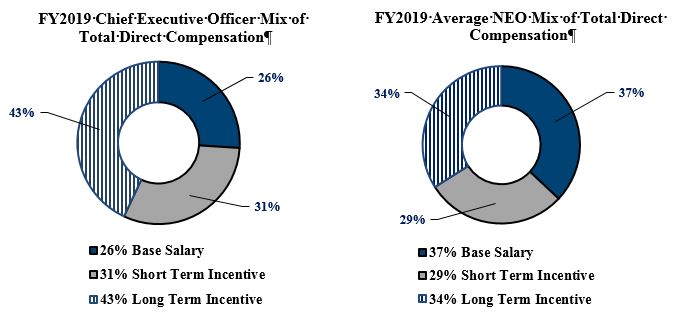

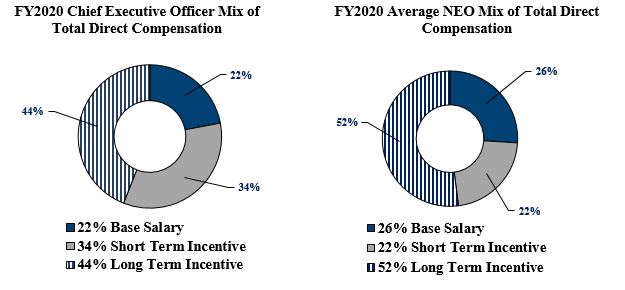

Fiscal Year 20192020 Total Direct Compensation Mix

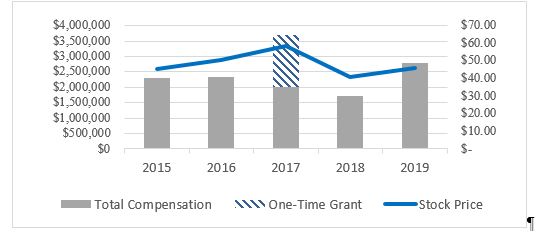

Fiscal Year 20192020 Executive Compensation Summary

| | Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Awards/ RSUs ($) | | Option /SARs Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonquali- fied Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) | | Year | | Salary ($) | | Bonus ($) | | Stock Awards/ RSUs ($) | | Option /SARs Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonquali- fied Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) |

| Thomas E. Ferguson | | 2019 | | $ | 724,500 |

| | — | | $ | 1,200,000 |

| | — | | $ | 844,767 |

| | — | | $ | 13,458 |

| | $ | 2,782,725 |

| | 2020 | | 746,235 |

| | — | | 1,500,000 |

| | — | | 1,137,262 |

| | — | | 28,707 |

| | 3,412,204 |

|

| President & Chief | | | | | | | | | | | | | | | | | | | | | | |

| Executive Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Paul W. Fehlman | | 2019 | | $ | 387,729 |

| | $ | 50,000 |

| | $ | 450,000 |

| | — | | $ | 293,860 |

| | — | | $ | 16,964 |

| | $ | 1,198,553 |

| | 2020 | | 395,484 |

| | — | | 450,000 |

| | — | | 391,766 |

| | — | | 14,583 |

| | 1,251,833 |

|

| Senior Vice President | | | | | | | | | | | | | | | | | | | | | | |

| & Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Matthew Emery | | 2019 | | $ | 297,432 |

| | $ | 50,000 |

| | $ | 225,000 |

| | — | | $ | 190,743 |

| | — | | $ | 11,803 |

| | $ | 774,978 |

| |

| Chief Information | | | | | | | | | | | | | |

| & Human Resources Officer | | | | | | | | �� | | | | | |

| | | | | | | | | | | | | | |

| Tara D. Mackey | | 2019 | | $ | 349,247 |

| | $ | 50,000 |

| | $ | 300,000 |

| | — | | $ | 223,972 |

| | — | | $ | 6,448 |

| | $ | 929,667 |

| | 2020 | | 361,471 |

| | — | | 300,000 |

| | — | | 302,985 |

| | — | | 11,921 |

| | 976,377 |

|

| Chief Legal Officer | | | | | | | | | | | | | | | | | | | | | | |

| & Secretary | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Gary Hill | | | 2020 | | 344,780 |

| | — | | 1,446,250 |

| | — | | 313,836 |

| | — | | 27,117 |

| | 2,131,983 |

|

| President and General | | | | | | | | | | | |

| Manager - Industrial | | | | | | | | | | | |

| | | | | | | | | | | | |

| Kenneth Lavelle | | 2019 | | $ | 309,000 |

| | $ | 50,000 |

| | $ | 250,000 |

| | — | | $ | 157,204 |

| | — | | $ | 3,900 |

| | $ | 770,104 |

| | 2020 | | 319,815 |

| | — | | 696,200 |

| | — | | 209,319 |

| | — | | 19,071 |

| | 1,244,405 |

|

| President and General | | | | | | | | | | | | | | | | | | | | | | |

| Manager - Electrical | | | | | | | | | | | | | | | | | | | | | | |

PROXY STATEMENT

FOR

20192020 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on July 9, 20198, 2020

The board of directors of AZZ Inc. (the “Company” or “AZZ”) is soliciting proxies for the 20192020 Annual Meeting of Shareholders (the “Annual Meeting”). You are receiving this Proxy Statement because you own shares of AZZ common stock that entitle you to vote at the Annual Meeting. This Proxy Statement contains information on Annual Meeting matters to assist you in voting your shares.

QUESTIONS AND ANSWERS

Proxy Materials and Voting Information

Why am I receiving these materials?

AZZ has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail in connection with the Company’s solicitation of proxies for use at the Annual Meeting to be held on Tuesday,Wednesday, July 9, 20198, 2020 at 10:00 a.m. local time at One Museum Place, 4th Floor, 3100 West 7th Street, Fort Worth, Texas 76107, and at any postponement(s) or adjournment(s) thereof. These materials were first sent or made available to shareholders on or about May 28, 2019.27, 2020. You are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

What is included in these materials?

These materials include:

|

| | | |

| | • | | This Proxy Statement for the Annual Meeting; and |

|

| | | |

| | • | | The Company’s Annual Report on Form 10-K for the fiscal year ended February 28, 2019,29, 2020, as filed with the Securities and Exchange Commission (the “SEC”) on May 17, 2019April 29, 2020 (the “Annual Report”). |

If you requested printed versions by mail, these materials also include the proxy card and voting instructions for the Annual Meeting.

What items will be voted on at the Annual Meeting?

You will be voting on the following:

The election of nineeight (8) nominees to the Company’s board of directors named in this Proxy Statement, each to serve for a one year term (Proposal 1);

A non-binding advisory resolution to approve AZZ’s executive compensation program (Proposal 2); and

Ratification of the appointment of Grant Thornton LLP to serve as AZZ’s independent registered public accounting firm for the fiscal year ending February 29, 202028, 2021 (Proposal 3).

We also will consider any other business that may properly come before the meeting.

What are the Board of Directors’ voting recommendations?

The board of directors recommends that you vote your shares:

“FOR” the election of the nineeight (8) nominees to serve on the Board for a one year term (Proposal 1);

“FOR” the approval of AZZ’s executive compensation program (Proposal 2); and

“FOR” the ratification of the appointment of Grant Thornton LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending February 29, 202028, 2021 (Proposal 3).

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, AZZ uses the Internet as the primary means of furnishing proxy materials to shareholders. Accordingly, the Company has sent a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s shareholders. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request a printed set of the proxy materials. Instructions on how to access the proxy materials on the Internet or to request a printed copy are detailed in the Notice. In addition, shareholders are always able to request printed proxy materials by mail or electronically by emailing www.azz.com/investor-relations. The Company encourages shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its annual meetings and the cost to the Company associated with printing and mailing hard copies of proxy materials.

How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to use the Internet to:

|

| | | |

| | • | | View the Company’s proxy materials for the Annual Meeting; and |

|

| | | |

| | • | | Instruct the Company to send future proxy materials to you by email. |

The Company’s proxy materials are also available at www.azz.com/investor-relations. This website address is included for reference only. The information contained on the Company’s website is not incorporated by reference into this Proxy Statement.

Choosing to receive future proxy materials by email will reduce the impact of the Company’s annual meetings on the environment and save the Company the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

Who may vote at the Annual Meeting?

Each share of the Company’s common stock has one vote on each matter. Only shareholders of record as of the close of business on May 10, 2019,8, 2020, the Record Date, are entitled to receive notice of, to attend, and to vote at the Annual Meeting. In addition to shareholders of record of the Company’s common stock, beneficial owners of shares held in street name as of the Record Date can vote using the methods described below. As of the Record Date, approximately 26,131,24626,158,957 shares of the Company’s common stock were issued and outstanding.

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

Shareholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Computershare Investor Services, LLC (“Computershare”), you are considered the shareholder of record with respect to those shares, and the Notice was delivered directly to you by the Company.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and a Notice was forwarded to you by that organization. As a beneficial owner, you have the right to instruct your broker, bank, trustee, or nominee how to vote your shares.

If I am a shareholder of record of the Company’s shares, how do I vote?

If you are a shareholder of record, there are four ways to vote:

|

| | | |

| | | | In person. You may vote in person at the Annual Meeting by requesting a ballot when you arrive. You must bring valid picture identification such as a driver’s license or passport and may be requested to provide proof of stock ownership as of the Record Date. |

|

| | | |

| | | | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice. |

|

| | | |

| | | | By Telephone. If you request printed copies of the proxy materials by mail or viewed electronic copies, you may vote by proxy by calling the toll free number found on the proxy card. |

|

| | | |

| | | | By Mail. If you request printed copies of the proxy materials by mail, you will receive a proxy card and you may vote by proxy by filling out the proxy card and returning it in the envelope provided. |

If I am a beneficial owner of shares held in street name, how do I vote?

If you are a beneficial owner of shares held in street name, there are four ways to vote:

|

| | |

| | | In person. If you are a beneficial owner of shares held in street name and wishyou want to vote in person at the Annual Meeting, you must obtain a “legal proxy” from the organization that holds your shares. A legal proxy is a written document that will authorize you to vote your shares held in street name at the Annual Meeting. Please contact the organization that holds your shares for instructions regarding obtaining a legal proxy. You must bring a copy of the legal proxy to the Annual Meeting and ask for a ballot when you arrive. You must also bringarrive and a valid picture identification such as a driver’s license or passport. In order for your vote to be counted, you must provide both the copy of the legal proxy and your completed ballot to the inspector of election. |

|

| | |

| | • | Via the Internet. You may vote by proxy via the Internet by visiting www.envisionreports.com/AZZ and entering the control number found in your Notice. The availability of Internet voting may depend on the voting process of the organization that holds your shares. |

|

| | |

| | • | By Telephone. If you request printed copies or viewed electronic copies of the proxy materials, you may vote by proxy by calling the toll free number found on the voting instruction form. The availability of telephone voting may depend on the voting process of the organization that holds your shares. |

|

| | |

| | • | By Mail. If you request printed copies of the proxy materials by mail, you will receive a voting instruction form and you may vote by proxy by filling out the voting instruction form and returning it in the envelope provided. |

What is the quorum requirement for the Annual Meeting?

A majority of the shares entitled to vote at the Annual Meeting must be present at the Annual Meeting in person or by proxy for the transaction of business. This is calledbusiness, commonly referred to as a quorum. Your shares will be counted for purposes of determining if there is a quorum if you:

|

| | | |

| | • | | Are entitled to vote and you are present in person at the Annual Meeting; or |

|

| | | |

| | • | | Have properly voted by proxy on the Internet, by telephone or by submitting a proxy card by mail. |

If a quorum is not present, we may propose to adjourn the Annual Meeting to solicit additional proxies.

How are proxies voted?

All shares represented by valid proxies received prior to the taking of the vote at the Annual Meeting will be voted and, where a shareholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the shareholder’s instructions.

What happens if I do not give specific voting instructions?

Shareholders of Record. If you are a shareholder of record and you:

|

| | | |

| | • | | Indicate when voting on the Internet or by telephone that you wish to vote as recommended by AZZ’s board of directors; or |

|

| | | |

| | • | | Sign and return a proxy card without giving specific voting instructions, |

then the persons named as proxy holders, Thomas E. Ferguson and Paul W. Fehlman,Tara D. Mackey, will vote your shares in the manner recommended by AZZ’s board of directors on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote on routine matters but cannotis not permitted to vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Which ballot measures are considered “routine” or “non-routine”?

The election of directors (Proposal 1) and the non-binding advisory resolution approving the Company’s executive compensation program (Proposal 2) are considered non-routine matters under applicable rules. A broker or other nominee cannot vote your shares without instructions on non-routine matters, and therefore broker non-votes may exist in connection with Proposals 1 and 2.

The proposal for the ratification of the appointment of Grant Thornton LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending February 29, 202028, 2021 (Proposal 3) is considered a routine matter under applicable rules. A broker or other nominee may generally vote your shares on routine matters, and therefore no broker non-votes are expected in connection with Proposal 3.

What is the voting requirement to approve each of the proposals?

The following table sets forth the voting requirement with respect to each of the proposals:

|

| | |

Proposal | | Voting Requirement |

1. Election of nineeight (8) director nominees named in this Proxy Statement, each for a one year term. | | Each director must be elected by a majority of the votes cast. A majority of votes cast means that the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” that director. Any director not elected by a majority is expected to tender to the Boardboard his or her resignation promptly following the certification of election results pursuant to the Company’s Bylaws. The nominating and corporate governance committee will make a recommendation to the board on whether to accept or reject such resignation. The board will act on such recommendation and publicly disclose its decision within 90 days from the date of the certification of the election results. |

2. Approval, on a non-binding advisory basis, of the Company’s executive compensation program. | | To be approved, this proposal must be approved by a majority of the votes cast by the shareholders present in person or represented by proxy, meaning that the votes cast by the shareholders “FOR” the approval of the proposal must exceed the number of votes cast “AGAINST” the approval of the proposal. |

3. Ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal year 2020.2021. | | To be approved, this proposal must be approved by a majority of the votes cast by the shareholders present in person or represented by proxy, meaning that the votes cast by the shareholders “FOR” the approval of the proposal must exceed the number of votes cast “AGAINST” the approval of the proposal. |

How are broker non-votes and abstentions treated?

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. Only “FOR” and “AGAINST” votes are counted for purposes of determining the votes received in connection with each proposal.

With respect to the election of directors (Proposal 1), under the majority voting policy adopted by the Company in 2014, broker non-votes and abstentions, which have the same effect as “AGAINST” votes, could cause a director nominee to fail to obtain the required affirmative votes of (i) a majority of the shares present or represented by proxy and voting at the Annual Meeting and (ii) a majority of the shares required to constitute a quorum.

With respect to each of Proposals 2 and 3, broker non-votes and abstentions could prevent the proposal from receiving the required affirmative votes of a majority of the shares present or represented by proxy and voting at the Annual Meeting assuming that the number of shares present or represented by proxy at the Annual Meeting are sufficient to constitute a quorum.

In order to minimize the number of broker non-votes, the Company strongly encourages you to vote or to provide voting instructions with respect to each proposal to the organization that beneficially holds your shares by carefully following the instructions provided in the Notice.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the taking of the vote at the Annual Meeting. Prior to the applicable cutoff time, you may change your vote using the Internet or telephone methods described above, in which case only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted. You may also revoke your proxy and change your vote by signing and returning a new proxy card dated as of a later date, or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you properly vote at the Annual Meeting or specifically

request that your prior proxy be revoked by delivering a written notice of revocation to the Company’s Secretary at One Museum Place, 3100 West 7th Street, Suite 500, Fort Worth, Texas 76107 prior to the Annual Meeting.

Who will serve as the inspector of election?

A representative from Computershare Investor Services, LLC will serve as the inspector of election.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

|

| | | |

| | • | | As necessary to meet applicable legal requirements; |

|

| | | |

| | • | | To allow for the tabulation and certification of votes; and |

|

| | | |

| | • | | To facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to AZZ’s management and the board of directors.

Where can I find the voting results of the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be tallied by the inspector of election after the taking of the vote at the Annual Meeting. The Company will disclose the final voting results in a Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the Annual Meeting.

How can I attend the Annual Meeting?

Admission to the Annual Meeting is limited to AZZ shareholders or their proxy holders. In order to be admitted to the meeting, each shareholder must present proof of stock ownership and a valid government-issued photopicture identification, such as a driver’s license or passport. Proof of stock ownership may consist of the proxy card or if shares are held in the name of a broker, bank or other nominee, an account statement or letter from the nominee indicating that you beneficially owned shares of AZZ common stock at the close of business on May 10, 2019,8, 2020, the Record Date for the Annual Meeting.

Although we intend to hold the Annual Meeting in person, we are monitoring the protocols that federal, state and local governments may recommend or require in light of the evolving coronavirus (COVID-19) pandemic. If we should determine it is necessary or appropriate to take additional steps regarding how we conduct our meeting, we will announce our decision in advance and details on how to participate will be posted on our website and filed with the SEC.

What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 20202021 Annual Meeting of shareholders?

Requirements for Shareholder Proposals to Be Considered for Inclusion in the Company’s Proxy Materials. Proposals that a shareholder intends to present at the 20202021 annual meeting of shareholders (“20202021 Annual Meeting of Shareholders”) and wishes to be considered for inclusion in the Company’s Proxy Statement relating to the 20202021 Annual Meeting of Shareholders must be received no later than January 21, 2020.20, 2021. All proposals must comply with Rule 14a-8 under the Exchange Act, which lists the requirements for the inclusion of shareholder proposals in company

sponsored proxy materials. Shareholder proposals must be delivered to the Company’s Secretary by mail at One Museum Place, 3100 West 7th Street, Suite 500, Fort Worth, Texas 76107.

Requirements for Other Shareholder Proposals to Be Brought Before the 20202021 Annual Meeting of Shareholders and Director Nominations. Notice of any proposal that a shareholder intends to present at the 20202021 Annual Meeting of Shareholders, but does not intend to have included in the Company’s Proxy Statement for the 20202021 Annual Meeting of Shareholders, as well as any director nominations, must be delivered to the Company’s Secretary by mail at One Museum Place, 3100 West 7th Street, Suite 500, Fort Worth, Texas 76107, not earlier than the close of business on March 9, 20207, 2021 and not later than the close of business on April 8, 2020.6, 2021. The notice must be submitted by a shareholder of record and must set forth the information required by the Company’s Bylaws with respect to each director nomination or other proposal that the shareholder intends to present at the 20202021 Annual Meeting of Shareholders. If you are a beneficial owner of shares held in street name, you can contact the organization that holds your shares for information regarding how to register your shares directly in your name as a shareholder of record.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Bylaws, as amended, provide that the board of directors will consist of up to 12 members, each serving a one year term. We currently have nine directors whoAll of the current members of the board are standing for re-election at the Annual Meeting.Meeting, except for Mr. Pirnat, who passed away on February 9, 2020. The Company sincerely appreciated his years of dedicated service and significant contributions to the board. Our nominating and corporate governance committee has determined that our current board of directors’ composition of nineeight directors, is sufficient from a governance perspective. Proxies cannot be voted for a greater number of nominees than the number of nominees named herein.

Our Bylaws require that, in an uncontested election, each director will be elected by a majority of the votes cast. If a nominee in an uncontested election does not receive a majority of the votes cast, he or she is required to promptly tender a resignation to the board of directors that is subject to acceptance or rejection by the board of directors within 90 days from the date of the certification of the election results. In the event an election of directors is contested, the voting standard will be a plurality of votes cast.

The board of directors has nominated the directors noted below, for election each to serve a one year term expiring at the 20202021 Annual Meeting of Shareholders. All of the nominees currently serve as members of the board of directors with a term expiring at this year’s Annual Meeting. Because these elections are uncontested, a nominee for director must receive a majority of the votes properly cast at the meeting in person or by proxy in order to be elected. Therefore, a director nominee who receives more than 50% of votes “FOR” election (measured with respect to the total votes cast with respect to such nominee) will be elected, provided that a quorum is present at the meeting.

Each of the director nominees has consented to serve if elected. If for any unforeseen reason a nominee would be unable to serve if elected, the beneficial owners of AZZ’s shares as of the Record Date of the Annual Meeting may exercise their discretion to vote for a substitute nominee selected by the board of directors. However, the board of directors has no reason to anticipate that any of the nominees will not be able to serve, if elected.

|

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES LISTED BELOW.

|

Nominees:Nominees for Election of Directors:

|

| | |

| DANIEL E. BERCE |

Age: 6566 Director Since: 2000 | | Board Committees: • Audit Committee (Chairman) • Compensation Committee |

Daniel E. Berce has served as President and Chief Executive Officer of General Motors Financial Company, Inc. (formerly AmeriCredit Corp.) since its acquisition by General Motors Company in October 2010. Mr. Berce also served as AmeriCredit Corp.’s Chief Executive Officer from 2005 until 2010, President from 2003 until 2010 and Chief Financial Officer from 1990 until 2003. He served as a director of Americredit Corp. from 1990 to 2010. Before joining Americredit Corp., Mr. Berce was a partner with Coopers & Lybrand, an accounting firm. Mr. Berce currently serves as a director of FirstCash, Inc., a publicly held international operator of retail pawn stores in the U.S. and Latin America, and Arlington Asset Investment Corp., a publicly held investment firm investing primarily in mortgage-related assets.

We believe Mr. Berce’s qualifications to serve on the board of directors include his executive level leadership experience, his experience serving as a Chief Executive Officer of a publicly held company and as a director of multiple publicly held companies, as well as his knowledge of corporate governance, executive compensation, accounting and executive compensation.financial expertise.

|

| | |

| PAUL EISMAN |

Age: 6364 Director Since: 2016 | | Board Committees: • Audit Committee • Compensation Committee |

Paul Eisman formerly served as the President and Chief Executive Officer of Alon USA Energy, Inc. (“Alon”) and as a director and the President and Chief Executive Officer of Alon USA Partners, LP. He has more than 30 years of refining experience and executive level leadership expertise in refining production and retail business operations. Prior to joining Alon in 2010, Mr. Eisman served as Executive Vice President of Refining and Marketing Operations with Frontier Oil Corporation from 2006 to 2010. From 2003 to 2006, he served as Vice President of KBC Advanced Technologies, a leading consulting firm to the international refining industry. Mr. Eisman served as Senior Vice President, Planning for Valero Energy Corporation from 2001 to 2002. Mr. Eisman also served in various executive leadership roles at Diamond Shamrock Corporation from 1979 to 2001.

We believe Mr. Eisman’s qualifications to serve on the Company’s board of directors include his extensive experience in various executive leadership positions in refining production and retail business operations.

|

| | |

| DANIEL R. FEEHAN |

Age: 6869 Director Since: 2000 Chairman of the Board Since: 2019 | | Board Committees: • Compensation Committee • Nominating and Corporate Governance Committee (Chairman) |

Daniel R. Feehan serves as Chairman of the Board of FirstCash, Inc., a publicly held international operator of retail pawn stores in the U.S and Latin America. Previously, Mr. Feehan served as a director of Cash America International, Inc. (“Cash America”) since 1984 and was Cash America’s Executive Chairman from November 2015 until Cash America’s merger with First Cash Financial Services, Inc. (now FirstCash, Inc.) in September 2016. Prior to that, Mr. Feehan served as Chief Executive Officer of Cash America from February 2000 to October 2015 and as President from February 2000 to May 2015. From 1990 to 2000, he served as President and Chief Operating Officer of Cash America. Mr. Feehan also currently serves as a director of Enova International Inc., a publicly held leading provider of online financial services to non-prime consumers and small businesses.

We believe Mr. Feehan's qualifications to serve on the Company’s board of directors include his executive level leadership experience and ability to provide direction and oversight to the Company's financial reporting and business controls, specifically his experience as a chief executive officer of a publicly held company, experience in finance, accounting, strategic planning and experience serving as a director of multiple publicly held companies.

|

| | |

| THOMAS E. FERGUSON |

Age: 6263 Director Since: 2013 | | Board Committees: • None |

Thomas E. Ferguson serves as a non-independent director and as the Company's President and Chief Executive Officer . Prior to joining AZZ, he was a consultant and served as interim Chief Executive Officer of FlexSteel Pipeline Technologies, Inc., a provider of pipeline technology products and services in 2013. Mr. Ferguson has also served in various executive capacitieslevel leadership roles with Flowserve Corporation, a publicly held global provider of fluid motion and control products, including Senior Vice President from 2006 to 2010, as President of Flow Solutions Group from 2010 to 2012, as President of Flowserve Pump Division from 2003 to 2009, as President of Flow Solutions Division from 2000 to 2002, as Vice President and General Manager of Flow Solutions Division North America from 1999

to 2000 and as Vice President of Marketing and Technology for Flow Solutions Division from 1997 to 1999. Mr. Ferguson retired from Flowserve Corporation in 2012.

We believe Mr. Ferguson’s qualifications to serve on the Company’s board of directors include his considerable global business and leadership experience serving as an executive officer of a public company, his domestic and international strategic experience both in the industries in which AZZ operates, and his track record for helping businesses achieve exponential growth, both organically and through acquisitions in the global marketplace.

|

| | |

| KEVERN R. JOYCE |

Age: 7273 Director Since: 1997 Chairman of the Board: 2013-2019 | | Board Committees: • Nominating and Corporate Governance Committee |

Kevern R. Joyce formerly served as senior advisor to ZTEK Corporation, an energy technology company, from 2003 to 2006 and has served as a director since 1993. Mr. Joyce was President, Chief Executive Officer and Chairman of Texas New Mexico Power Company, an electric service company, from 1994 to 2001, and served as a senior advisor until 2003. Mr. Joyce is a consultant to and investor in various companies.

We believe Mr. Joyce’s qualifications to serve on the board of directors include his considerable business and leadership experience, his finance and accounting knowledge, and specifically his experience in the electrical power generation industry, where he previously served as the Chief Executive Officer of a publicly held electrical utility company.

|

| | |

| VENITA MCCELLON - ALLEN |

Age: 5960 Director Since: 2016 | | Board Committees: • Audit Committee • Compensation Committee |

Venita McCellon – Allen formerly served as the President and Chief Operating Officer of Southwestern Electric Power Company (“SWEPCO”), a subsidiary of American Electric Power Company, Inc. (“AEP”), a public utility holding company which engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers, and held such office from 2010 to 2018. Previously, she served as Executive Vice President – AEP Utilities East from 2009 to 2010 and Executive Vice President – AEP Utilities West from 2006 to 2009. From 2004 to 2006, Ms. McCellon-Allen served as Senior Vice President Shared Services of AEP.AEP responsible for information technology, supply chain management and human resources. From 2000 to 2004, she served as Senior Vice President - Human Resources for Baylor Health Care System, a diversified health care holding company. From 1995 to 2000, Ms. McCellon-Allen held various leadership roles at Central and South West Corp. (“CSW”), in operations, customer service, strategic planning and human resources. During 1997 to 2000, Ms. McCellon-Allen led CSW's merger integration with AEP. In her last position at CSW, she served as Senior Vice President for Corporate Development and Customer Service.

We believe Ms. McCellon-Allen’s qualifications to serve on the board of directors include her considerable business and executive level leadership experience bothin operations, corporate governance, external affairs, regulatory matters, merger integration, talent development and executive compensation all within and outside of the energy industry.

|

| | |

| ED MCGOUGH |

Age: 5859 Director Since: 2017 | | Board Committees: • Compensation Committee (Chairman) • Nominating and Corporate Governance Committee |

Ed McGough has served as the Senior Vice President of Global Manufacturing and Technical Operations at Alcon Laboratories, Inc. (“Alcon”), a division of Novartis AG, since 2008. Alcon is the global leader in eye care developing, manufacturing and distributing innovative medical devices for eye care needs. Mr. McGough joined Alcon in 1991 as a Manager of Quality Assurance and Regulatory Affairs in Alcon’s Pennsylvania facility. He has

held various other leadership positions at Alcon in both Fort Worth, Texas and Puerto Rico, including: Director of Quality Assurance from 1992 to 1994; Director of Operations from 1994 to 1996; Director of Manufacturing from 1996 to 2000; and Vice President and General Manager of Manufacturing in Fort Worth, Texas and Houston, Texas from 2000 to 2006. Following these roles, he served as Vice President, Manufacturing, Pharmaceutical Operations, responsible for Alcon’s pharmaceutical plants in the United States, Brazil, Mexico, Spain, Belgium and France. Prior to joining Alcon, Mr. McGough served in various quality engineering and management roles with Baxter Healthcare Corporation from 1983 to 1991.

We believe Mr. McGough’s qualifications to serve on the board of directors include (i) his executive level leadership and international experience in global manufacturing, distribution and global supply chain; and (ii) his experience with the integration of acquired medical device companies into Alcon, which aligns well with our Company's long term acquisition strategy.

|

| | |

STEPHEN E. PIRNAT |

Age: 67

Director Since: 2014

| | Board Committees:

• Audit Committee

• Nominating and Corporate Governance Committee

|

Stephen E. Pirnat formerly served as Chairman and Chief Executive Officer of ClearSign Combustion Inc. ("ClearSign") from 2015 to 2018 and served as a director of ClearSign from 2011 to 2018. From 2011 to 2014, Mr. Pirnat served as the Managing Director of Europe, the Middle East and Africa for the Quest Integrity Group of Team, Inc., a provider of asset integrity management and asset reliability solutions in the refinery, chemical, petrochemical, pipeline and power industries worldwide. From 2009 until 2015, Mr. Pirnat held the position of President and Chief Executive Officer of Quest Metrology Group LLC. From 2009 to 2014, he served as President of Quest Integrated Inc., a technology incubator and boutique private equity firm. From 2000 to 2009, Mr. Pirnat served as President and Chief Executive Officer of the John Zink Company, LLC, a wholly owned subsidiary of Koch Industries and a worldwide leader in the supply of combustion and air pollution control equipment to the energy industry. In that former capacity, Mr. Pirnat was a Board member of Quest Integrity Group. Mr. Pirnat, a long-time executive with Ingersoll-Rand and Ingersoll-Dresser Corporation, went to John Zink from a previous post as President and Chief Executive Officer of Pangborn Corporation, a leading supplier of surface preparation equipment and associated services to the automotive and aircraft industries. Mr. Pirnat began his career as an applications engineer with the Pump and Condenser group of Ingersoll-Rand, where he advanced through a variety of sales, marketing, engineering and operations positions with that company and its successor, Ingersoll-Dresser.

We believe Mr. Pirnat’s qualifications to serve on the board of directors include his expertise in providing infrastructure solutions to large industrial companies both in the U.S. and internationally, and his extensive experience in the industries in which our Company operates.

|

| | |

| STEVEN R. PURVIS |

Age: 5455 Director Since: 2015 | | Board Committees: • Audit Committee • Nominating and Corporate Governance Committee |

Steven R. Purvis is a Principal of Luther King Capital Management (“LKCM”). He joined the firm in 1996 as Director of Research, became Co-Manager on the Small Cap Strategy in 1998 and Lead Manager in 2000. Mr. Purvis currently serves as a Portfolio Manager responsible for small cap and small mid-cap public equity focused investment portfolios. In addition to his public markets experience, he has also led and participated in many venture capital, private equity and real estate investments. He has been a Principal of LKCM since 2004 and a Trustee to the LKCM Funds since 2013. Prior to joining LKCM, Mr. Purvis served as a Senior Analyst to Roulston Research from 1993 to 1996 and also served as a Research Analyst at Waddell & Reed, Inc. from 1990 to 1993. Since 2001, he has served as Chairman and significant shareholder of KGP Group, Inc., a private international manufacturing company focused on the aerospace and packaging industries. Mr. Purvis is also currently serving as the Saints Foundation investment committee chair, which supports All Saints Episcopal School of Fort Worth, Texas.

We believe Mr. Purvis’s qualifications for serving on the board of directors includes his distinguished career as a portfolio manager in the public equity markets with a focus on small to mid-cap companies, experience in analyzing corporate strategy and investment decisions across multiple industries and his ability to add an additional layer of financial analytics to the board’s deliberations.

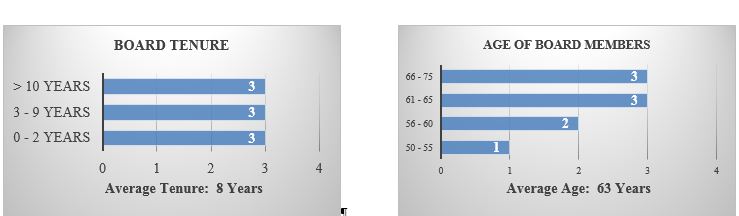

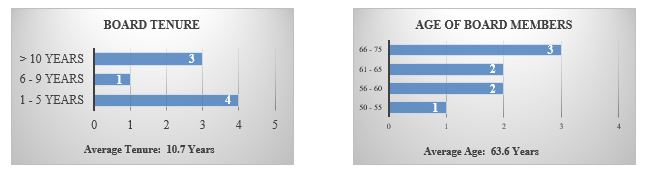

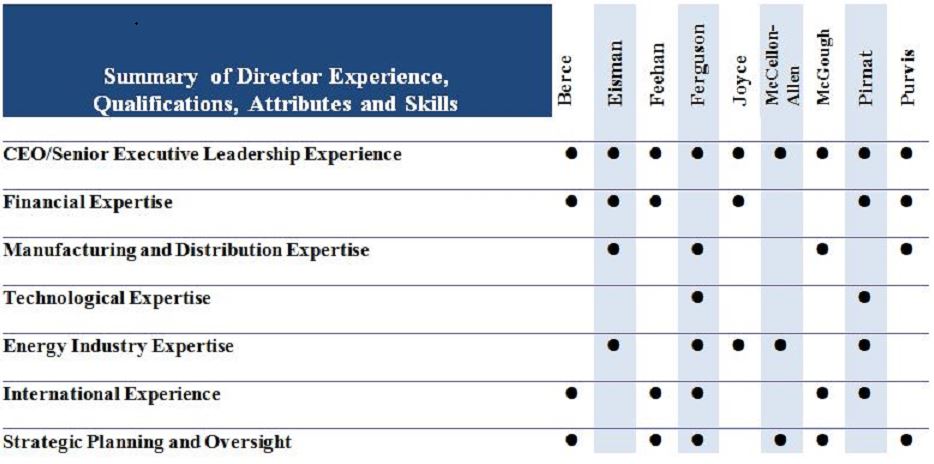

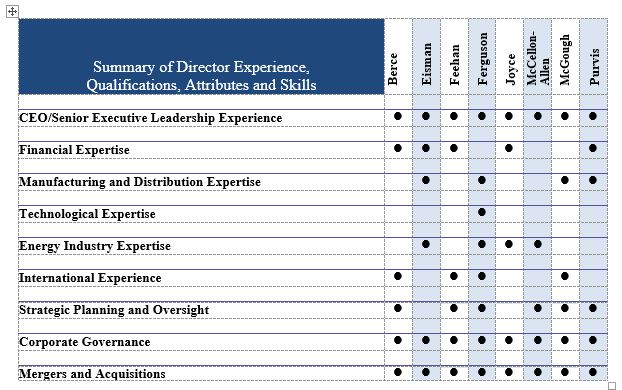

Our board of directors, acting through the nominating and corporate governance committee ensures the Company’s board has diverse professional expertise, strong skills and qualifications. The board believes that the collective combination of backgrounds, skills and experience levels of its members has produced a board that is well equipped to exercise independent and robust oversight responsibilities for AZZ’s shareholders and to help guide the Company’s management team in achieving AZZ’s long-term strategic objectives.

MATTERS RELATING TO CORPORATE GOVERNANCE, BOARD STRUCTURE,

DIRECTOR COMPENSATION AND STOCK OWNERSHIP

Corporate Governance

The board of directors believes that strong corporate governance is a prerequisite to the continued success of the Company. The board of directors has adopted formal, written Corporate Governance Guidelines designed to strengthen AZZ’s corporate governance. Among other things, the guidelines contain standards for determining whether a director is independent, based upon the independence requirements of the New York Stock Exchange (the “NYSE”). The nominating and corporate governance committee is responsible for overseeing and reviewing the Company's Corporate Governance Guidelines and Code of Conduct at least annually and recommending any proposed changes to the full board of directors for its approval. On January 20, 2016,During the year, the board of directors amended the Company’s Code of Conduct applicable to all of our directors, officers and employees, and the charters for each board of directors committee to provide greater emphasis and clarity of evolving legal and regulatory requirements and best practices. The Corporate Governance Guidelines, Code of Conduct and charters for the audit, compensation and nominating and corporate governance committees are available on the Company’s website at www.azz.com, under the heading “Investor Relations — Corporate Governance.”

You may also obtain a copy of these documents by making a request to:

|

| |

| | AZZ Inc. |

| | Investor Relations |

| | One Museum Place, Suite 500 |

| | 3100 West 7th Street |

| | Fort Worth, TX 76107 |

| | Telephone: 817-810-0095 |

| | Fax: 817-336-5354 |

| | Email: info@azz.com |

Corporate Responsibility and Sustainability

AZZ is committed to growing its business in a sustainable and socially responsible manner. We have organized our sustainability efforts using a framework that focuses on environmental stewardship, social responsibility and corporate governance (“ESG”) and integrated our sustainability strategy and initiatives into our overall business strategy. In November 2019, we formed a Sustainability Council with members selected based on their knowledge of sustainability issues and functional expertise to the AZZ business, who are focused on integrating sustainability into our operations and company culture. The board’s nominating and corporate governance committee provides oversight to the Sustainability Council and to AZZ’s ESG policies and sustainability practices. As part of our commitment towards good corporate responsibility, we have adopted a Vendor Code of Business Conduct, Environmental Health and Safety Policy and a Human Rights Policy, all of which are available online at www.azz.com/corporate-social-compliance.

We believe that investing in our people, in our communities in which we live and work, and in operating our business sustainably will drive long-term value for AZZ and its shareholders. We are committed to continuously improving our sustainability practice. We strive to improve the efficiency of our operations, focus on increased energy and resource efficiency, lower greenhouse gas emissions, reduce water consumption, conserve natural resources and offer products and services with superior sustainability attributes that meet or exceed our customer’s needs.

Shareholder Engagement

We believe that maintaining an active dialogue with our shareholders is important to our commitment to deliver sustainable, long-term value to our shareholders. Our CEO and members of our executive management team regularly engage with shareholders on various topics, including business initiatives and results, strategy and capital allocation. During fiscal year 2020, we conducted quarterly investor relations conference calls and participated in numerous investor road shows to address questions and provide perspective on the strategic direction of our Company. The feedback we receive from our shareholders provides the board of directors with insights into the scope of topics important to our shareholders.

Director Independence

It is our policy that the board of directors will at all times consist of a majority of independent directors. AZZ recognizes the importance of having an independent board of directors that is accountable to both AZZ and its shareholders. In addition, all members of the audit committee, compensation committee and nominating and corporate governance committee must be independent. To be considered independent, a director must satisfy the independence requirements established by the NYSE and the Securities and Exchange Commission (the “SEC”). The board of directors will consider and apply all facts and circumstances relating to each director in determining independence. The board of directors has determined that all of the current members of the board of directors have no material relationship with the Company and are independent within the meaning of the Company’s Corporate Governance Guidelines and Section 303A.02 of the NYSE Listed Company Manual, except for Thomas E. Ferguson. Mr. Ferguson is employed as the Company’s president and chief executive officer ("CEO"). Mr. Pirnat, who served with distinction on our board since 2014, passed away in February 2020. He was independent during his fiscal year 2020 tenure on our board.

New Director Orientation

The nominating and corporate governance committee is responsible for overseeing the Company's new director orientation program. The new director orientation program enables new members of the board to quickly become active, knowledgeable and effective board members. The Company's chief legal officer and secretary is responsible for administering the program and reporting to the nominating and corporate governance committee the status of the orientation process with respect to each new director. Orientation includes a visit to the Company's corporate headquarters for a personal comprehensive briefing by senior management on AZZ's strategic plans, significant financial, accounting and risk management, compensation practices, as well as the Company's policies, procedures and responsibilities of the board and its committees.

Continuing Director Education

AZZ encourages continuing director education for its board members to keep current on relevant developments in business, corporate governance and various issues pertaining to AZZ and the industries in which it participates. The Company provides continuing director education through individual speakers who make relevant presentations in connection with in-person board meetings. The Company's corporate secretary monitors pertinent developments in director education and recommends certain relevant outside programs for the board members to attend. The nominating and corporate governance committee reviews the director education process to ensure the continuing education provided remains relevant and helpful.

Directors’ Attendance at Board and Committee Meetings and at the Annual Meeting of Shareholders

Our board of directors met sixseven times during fiscal year 2019.2020. Although we have no formal policy on the matter, all directors are encouraged to attend, and typically have attended, our annual meeting of shareholders. All of our directors attended the 20182019 Annual Meeting of Shareholders .

|

|

All of the Company’s directors attended 100% of the total number of board meetings and meetings of the committees of the board on which the director served during fiscal year 2019.2020. |

Board Committees

The board of directors has established three standing board committees, the audit committee, the compensation committee and the nominating and corporate governance committee. Each committee is governed by a charter that is reviewed annually and revised as deemed necessary. A copy of each charter is available on the Company’s website at www.azz.com under the heading “Investor Relations − Corporate Governance.” Mr. Ferguson does not serve on any board committees. Current boardBoard committee membership for fiscal year 2020 is set forth below.

|

|

| AUDIT COMMITTEE |

Committee Members: Daniel E. Berce* (Chairman), Paul Eisman, Venita McCellon-Allen, Stephen E. Pirnat*(1) and Steven R. Purvis* |

| |

| Committee Functions |

| |

| • Oversees the Company’s accounting, auditing, financial reporting, systems of internal controls regarding finance and accounting and corporate finance strategy; |

| • Directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm; |

| • Pre-approves all auditing services and permitted non-audit services to be performed for the Company by its independent auditor; |

| • Reviews and discusses with management (i) the guidelines and policies that govern the processes by which the Company assesses and manages its exposure to risk; and (ii) the Company’s major financial and other risk exposures and the steps management has taken to monitor and control such exposures; |

| • Meets regularly in executive session with the Company’s management, internal and independent auditors; and |

• Reviews and approves any proposed related-party transactions consistent with the Company’s policy regarding such transactions and reports any findings to the full Board.board. |

| (1) Mr. Pirnat served on the Audit Committee until his death in February 2020. |

| Independent Members: 5 |

*Financial Experts: 32 |

FY2019FY2020 Audit Committee Meetings Held: 79 |

|

|

| COMPENSATION COMMITTEE |

Committee Members: Ed McGough (Chairman), Daniel E. Berce, Paul Eisman, Daniel R. Feehan, and Venita McCellon-Allen |

| |

| Committee Functions |

| |

| • Establishes, oversees and adjusts the Company’s incentive-based compensation plans, sets compensation for our CEO and approves compensation for the other executive officers; |

| • Reviews and discusses with management the Compensation Discussion & Analysis to be included in the Company’s annual report and proxy statement; |

| • Reviews and approves employment agreements, severance agreements or other significant matters relating to the Company’s CEO and other executive officers, including the annual performance review of the CEO; |

| • Assists the board in its oversight of the development, implementation and effectiveness of our policies and strategies relating to our human ca;ital management function, (including: recruiting, retention, career development, management succession and diversity and employment practices); |

• Reviews with management and recommends to the board changes in the Company’s compensation structure policies and programs and its competitiveness as an employer; and |

| • Administers the Company’s Compensation Recovery Policy allowing AZZ to recoup incentive based compensation paid to applicable officers and employees in the event of a financial restatement or misconduct. |

| Independent Members: 5 |

FY2019FY2020 Compensation Committee Meetings Held: 56 |

|

|

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

Committee Members: Daniel R. Feehan (Chairman), Kevern R. Joyce, Ed McGough, Stephen E. Pirnat(1) and Steven R. Purvis |

| |

| Committee Functions |

| |

| • Identifies potential individuals qualified to become members of the board consistent with criteria approved by the board; |

| • Recommends director candidates to the board for election at the annual meetings of shareholders or to fill vacancies pursuant to the Company’s Bylaws; |

| • Recommends director nominees to the board for each board committee and the chairman of the board; |

| • Responsible for establishing and overseeing AZZ’s Corporate Governance Guidelines, Code of Conduct and the director nomination process; |

| • Provides oversight of AZZ's environmental, social and governance ("ESG") policies and sustainability practices that are of significance to AZZ and its shareholders; |

| • Regularly reviews and makes recommendations to the board regarding director compensation; and |

| • Leads an annual process for evaluating the performance of the board as a whole and each of the board committees and report its findings and recommendations to the board. |

| (1) Mr. Pirnat served on the Nominating and Corporate Governance Committee until his death in February 2020. |

| Independent Members: 5 |

FY2019FY2020 Nominating and Corporate Governance Committee Meetings Held: 4 |

The following table identifies the current members of each of the board's committees effective as of April 4, 2019:board committee membership:

|

| | | |

| Director | Nominating and Corporate Governance Committee | Audit Committee | Compensation Committee |

| Daniel E. Berce | | | |

| Paul Eisman | | | |

| Daniel R. Feehan* | | | |

| Kevern R. Joyce | | | |

| Venita McCellon-Allen | | | |

| Ed McGough | | | |

Stephen E. Pirnat | | | |

| Steven R. Purvis | | | |

Member

Member Chair

Chair

* Chairman of AZZ's Board of Directors

Strategic Planning

The board has oversight responsibility for management's establishment and execution of corporate strategy and meets during the year with senior management to discuss and approve ourthe Company's strategic plans, financial goals, capital spending and other factors critical to successful performance. The Company's seniorexecutive management team provides quarterly reports to the board on the progress onof its objectives and strategies. During board meetings, directors review key issues, financial performance, market indicators and financial performance.the status of various acquisition opportunities. The CEO communicates regularly with the board on important business issues, opportunities and developments.

Meetings of Independent Directors without Management Present

To empower our independent directors to serve as a moreprovide effective check onoversight of management, our independent directors meet at regularly scheduled executive sessions without members of AZZ’s management present. The independent directors met without management present sixseven times during the last fiscal year. Executive sessions ordinarily are held in conjunction with quarterly scheduled board meetings. Mr. Feehan, as our independent chairman of the board of directors, presides over these meetings.

Board Leadership Structure

The board of directors has flexibility under its governance guidelines to select an appropriate leadership structure. The board of directors believes that it is preferable for one of its independent, non-employee members to serve as chairman because it places an independent director in a position of leadership on the board which it believes adds value to AZZ’s shareholders by facilitating a more efficient exercise of the board’s fiduciary duties. We believe the separation of the chairman and the chief executive officer positions allows the non-employee chairman to provide support and advice to the chief executive officer, reinforcing the reporting relationship and accountability of the chief executive officer to the board. The board of directors further believes this structure is appropriate given that the chief executive officer has the day-to-day responsibility to run the Company and the chairman of the board has the responsibility to lead and coordinate the functions of the board of directors. The non-employee directors appoint the non-management chairman of the board of directors. The duties of the board chairman are to:

• Preside at board meetings;

• Preside at executive sessions or other meetings of the non-employee directors;

Recommend the retention of any consultants, legal, financial or other professional advisors who are to report directly to the board of directors;

• Consult with management as to the agenda items for board and committee meetings; and

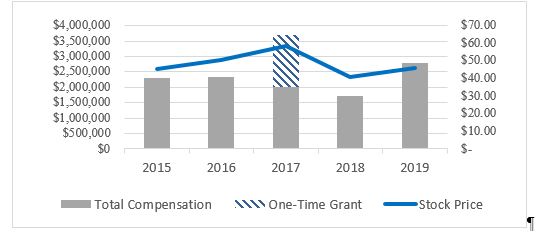

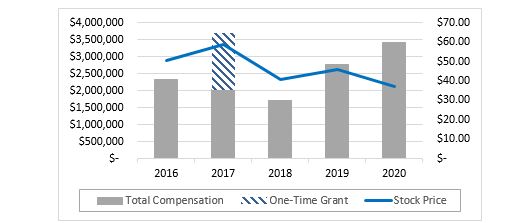

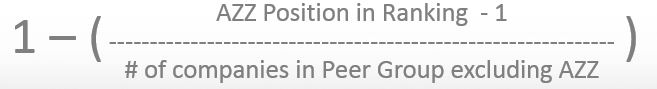

Coordinate with committee chairs in the development and recommendations regarding board and committee meeting schedules.